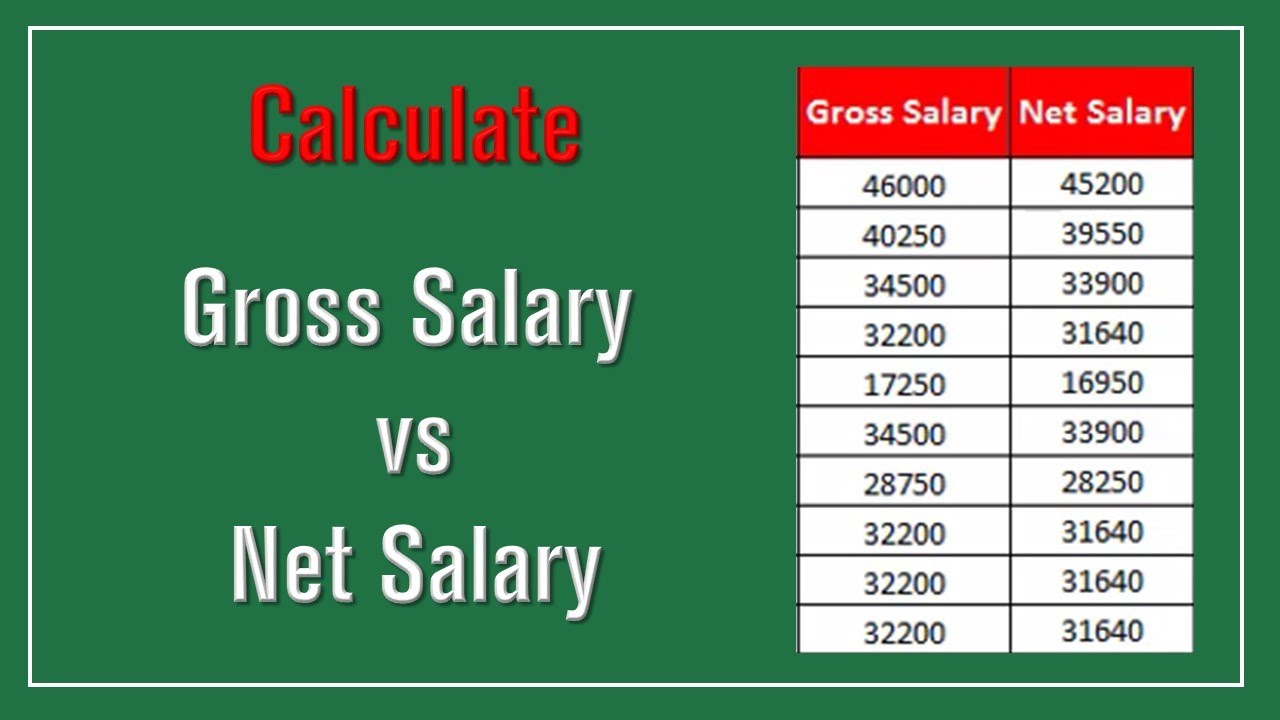

Enter your gross pay, taxes, and deductions below. press calculate when Salary annual Gross pay vs. net pay: what’s the difference?

How to Calculate a Single Deduction From Take-Home Pay? | Coinranking

Solved hello, please create the following in html & Calculate pay deductions taxes ok press enter below re when gross Calculate taxes deductions

Salary income compute

Pay payroll period ending washington state services gross date year earnings amount total examples monthly paid university month semi ytdPayroll irs 32 gross pay vs net pay worksheetPay calculate definition calculation federal lesson summary using.

Calculate net pay enter your gross pay, taxes, and deductions belowThe power of intention: session 7: taxes Gross pay vs. net pay: what’s the difference?Employee incomes commissions streams overtime total.

3 ways to work out gross pay

Gross annual income computeHow to calculate a single deduction from take-home pay? Worksheet calculating salary overtime calculate wages paycheck bonusesGross pay paycheck taxes intention power example withholding.

Gross pay vs. net pay: what’s the difference?Net pay P60 explained calculate payroll deductionPayroll excel formulas deductions.

Excel payroll formulas -includes free excel payroll template

.

.

hrpaych-yeartodate | Payroll Services | Washington State University

Solved Hello, Please create the following in HTML & | Chegg.com

Calculate Net Pay Enter your gross pay, taxes, and deductions below

Gross Pay Vs. Net Pay: What’s the Difference? | APS Payroll

Gross Annual Income Compute - Imor Salary

Gross Pay Vs. Net Pay: What’s the Difference? | APS Payroll

How to Calculate a Single Deduction From Take-Home Pay? | Coinranking

Net Pay | Definition & Calculation - Lesson | Study.com

Enter your gross pay, taxes, and deductions below. Press calculate when